NSDL PAN Verification: Discover the step-by-step process for verifying your PAN through NSDL. This guide covers online verification methods, bulk verification services, and answers to frequently asked questions to ensure seamless PAN validation.

NSDL PAN Verification

The Permanent Account Number (PAN) is a unique identifier essential for financial transactions and tax-related activities in India. Ensuring the accuracy and validity of your PAN is crucial to avoid potential legal and financial complications. The National Securities Depository Limited (NSDL) offers efficient services for PAN verification, catering to both individuals and organizations. This article provides a detailed walkthrough of the NSDL PAN verification process, including online methods, bulk verification services, and common queries.

Read More: PAN Correction Form: How to Update Your PAN Details?

Understanding PAN and Its Importance

What is PAN?

PAN stands for Permanent Account Number, a ten-character alphanumeric identifier issued by the Indian Income Tax Department. It serves as a universal identification key for all financial transactions and aids in tracking taxable activities.

Why is PAN Verification Essential?

Verifying your PAN ensures that:

- Your financial records are accurate and up-to-date.

- You comply with tax regulations, avoiding potential penalties.

- Fraudulent activities using your PAN are prevented.

Methods of PAN Verification

1. Online PAN Verification through NSDL

NSDL offers an online platform for instant PAN verification. Here’s how you can verify your PAN details:

Step-by-Step Guide:

- Visit the NSDL e-Governance Portal:

- Navigate to the NSDL PAN Verification page.

- Choose the Verification Mode:

- NSDL provides three modes:

- Screen-Based Verification: Enter PAN details directly on the screen.

- File-Based Verification: Upload a file containing multiple PANs for bulk verification.

- Software (API) Based Verification: Integrate your system with NSDL’s API for real-time verification.

- NSDL provides three modes:

- Register for the Service:

- Fill out the registration form with required details.

- Submit necessary documents as specified.

- Pay the applicable fees.

- Access the Verification Service:

- Upon successful registration, log in to your account.

- Use the chosen verification mode to verify PAN details.

Note: This service is particularly beneficial for organizations requiring bulk PAN verifications.

2. PAN Verification through the Income Tax Department’s e-Filing Portal

Individuals can verify their PAN details using the Income Tax Department’s e-Filing portal.

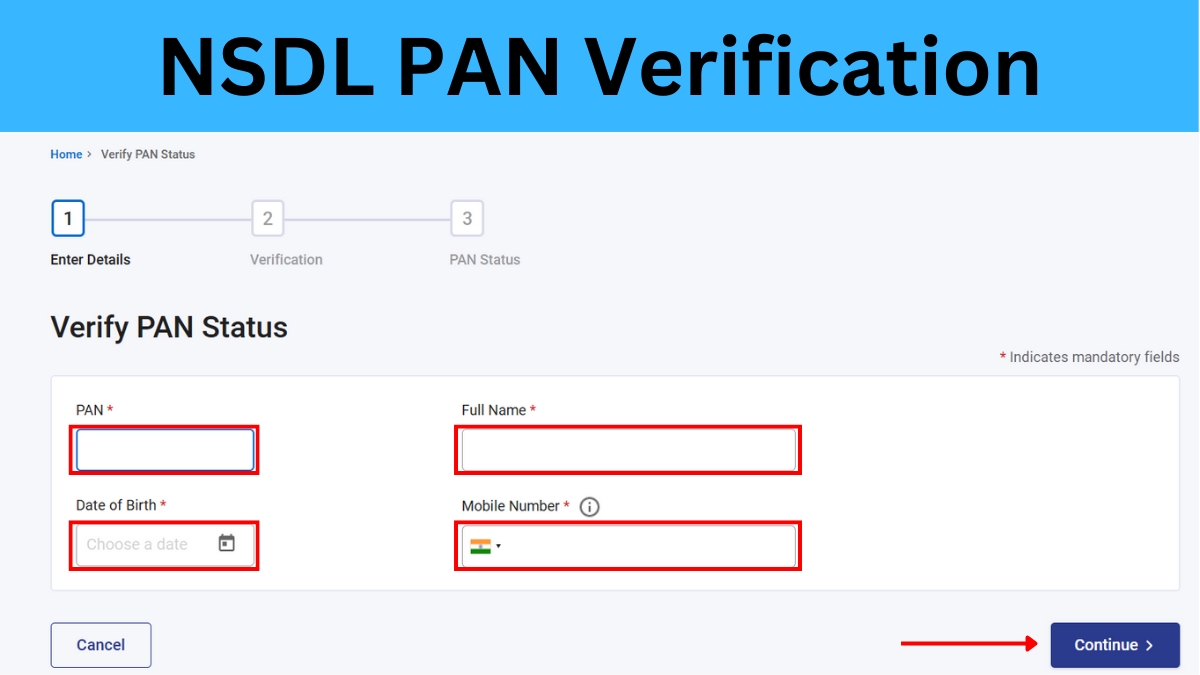

Steps to Verify PAN:

- Visit the e-Filing Portal:

- Go to the Income Tax e-Filing website.

- Access ‘Verify Your PAN’ Service:

- Click on ‘Verify Your PAN’ under the ‘Quick Links’ section.

- Enter PAN Details:

- Provide your PAN, full name, date of birth, and mobile number.

- Click ‘Continue’.

- Complete Verification:

- Enter the OTP sent to your registered mobile number.

- Upon successful validation, your PAN status will be displayed.

3. Bulk PAN Verification for Organizations

Entities such as banks, government agencies, and financial institutions often need to verify multiple PANs simultaneously. NSDL facilitates this through its bulk verification service.

Modes of Bulk Verification:

- File-Based Verification:

- Upload a file containing multiple PANs in a specified format.

- The system processes the file and provides verification results.

- API-Based Verification:

- Integrate your organization’s system with NSDL’s API.

- Enables real-time PAN verification within your applications.

Registration Process:

- Submit an application to NSDL with required documents.

- Upon approval, access credentials for the bulk verification system will be provided.

| Aspect | Details |

|---|---|

| What is PAN? | A 10-digit unique ID for financial and tax-related activities. |

| Why Verify PAN? | Ensures accuracy, compliance, and fraud prevention. |

| Verification Methods | 1. NSDL Portal (Screen, File, API-based) 2. Income Tax e-Filing Portal (PAN, Name, DOB, OTP). |

| Bulk PAN Verification | Used by banks & businesses via File Upload or API. |

| KYC & Aadhaar Link | Verify via e-Filing portal, ensure PAN-Aadhaar linking. |

| How to Check Status? | Use NSDL or Income Tax portal with PAN/Aadhaar. |

| Conclusion | Essential for tax compliance, fraud prevention & business verification. |

FAQs about NSDL PAN Verification

1. How can I verify my PAN with NSDL?

You can verify your PAN through NSDL by registering for their online PAN verification service. This service offers screen-based, file-based, and API-based verification modes suitable for both individuals and organizations.

2. How can I check my PAN card details in NSDL?

To check your PAN card details:

- Visit the NSDL PAN Verification page.

- Register or log in to access the verification services.

- Choose the appropriate verification mode and enter your PAN details to view the associated information.

3. How to Complete KYC Verification for PAN Card Online?

KYC (Know Your Customer) verification for PAN cardholders is necessary for financial transactions, stock market investments, and other regulatory purposes. You can complete your PAN KYC verification online using the following steps:

- Visit the Income Tax e-Filing Portal

- Go to the Income Tax e-Filing website.

- Login to Your Account

- Enter your PAN number as the User ID.

- Authenticate using OTP (One-Time Password) sent to your registered mobile number.

- Navigate to KYC Section

- Go to ‘Profile Settings’ and select ‘My Profile’.

- Click on ‘KYC’ and check the status of your PAN.

- Verify PAN and Aadhaar Linkage

- Ensure your PAN is linked to your Aadhaar for seamless verification.

- If not linked, update Aadhaar details through the Income Tax portal.

- Complete the KYC Process

- If verification is required, upload necessary documents (Aadhaar, passport, or voter ID).

- Submit the details and wait for confirmation.

Once your KYC is successfully verified, you will receive an acknowledgment message confirming that your PAN is valid for financial transactions.

4. How to Check Bulk PAN Verification?

Bulk PAN verification is useful for businesses, financial institutions, and government organizations that need to verify multiple PAN numbers at once.

Steps to Perform Bulk PAN Verification:

- Register for NSDL Bulk PAN Verification Service

- Visit the NSDL Bulk PAN Verification page.

- Submit an application with organization details and KYC documents.

- Wait for approval and credentials to access the bulk verification system.

- Choose a Verification Mode

- File-Based Verification: Upload a list of PAN numbers in a specified format (.CSV or .TXT).

- API-Based Verification: Integrate your organization’s system with NSDL’s PAN verification API for real-time checking.

- Submit the Request

- Upload or send the PAN details for verification.

- Wait for NSDL to process the data.

- Download the Verification Report

- Once processed, NSDL provides a report with the status of each PAN number.

Bulk verification is beneficial for banks, mutual funds, stockbrokers, and corporate entities that frequently validate customer details.

5. PAN Verification Using Aadhaar Number

If you don’t have your PAN number handy, you can verify your PAN using your Aadhaar number.

Steps to Verify PAN by Aadhaar:

- Visit the Income Tax e-Filing Portal

- Open the Income Tax Aadhaar-PAN Link Verification.

- Enter Your Aadhaar Number

- Provide your 12-digit Aadhaar number.

- Authenticate with OTP

- An OTP will be sent to your registered mobile number linked to Aadhaar.

- Enter the OTP to proceed.

- View PAN Verification Status

- Once authenticated, the system will display the PAN associated with the Aadhaar.

This method is useful if you have lost your PAN card details or need a quick verification process.

Read More: NSDL PAN Tracking: How many days after my application can I track my PAN card status?

Conclusion: NSDL PAN Verification

Verifying your PAN card through NSDL or the Income Tax e-Filing portal is essential for ensuring compliance with financial and tax regulations. Whether you are an individual checking your PAN details, a business performing bulk PAN verification, or someone looking to verify PAN via Aadhaar, NSDL provides a secure and efficient verification process.

By following the step-by-step methods outlined in this guide, you can quickly validate your PAN details, avoid fraud, and ensure smooth financial transactions. If you encounter any issues, NSDL and Income Tax customer support are available to assist with verification concerns.

For businesses, registering for NSDL’s bulk PAN verification service can streamline customer verification processes and improve compliance with financial regulations.