PAN Card Change Form: Learn how to update your PAN card details using the PAN card change form. Get a step-by-step guide for online and offline PAN card corrections, required documents, fees, and FAQs.

PAN Card Change Form

Updating your PAN (Permanent Account Number) card is essential when there are errors in your personal details or when you need to make necessary corrections. Whether you need to correct your name, date of birth, address, or other personal details, the PAN card change form helps you submit updates easily. In this guide, you will learn everything about the PAN card correction process, how to submit a request online and offline, the required documents, fees, and answers to frequently asked questions.

What Is a PAN Card and Why Is It Important?

A PAN card is a 10-digit alphanumeric number issued by the Income Tax Department of India. It serves as a unique identification for individuals and businesses for financial transactions, including:

- Filing income tax returns

- Opening a bank account

- Purchasing property or vehicles

- Applying for credit cards and loans

- Investing in the stock market

If there are mistakes in your PAN card details, it is crucial to get them corrected to avoid issues with tax filing and financial transactions.

Read More: NSDL PAN Photo Resize: How to resize PAN Card Photo?

Why Do You Need to Use the PAN Card Change Form?

There are several reasons why you may need to correct or update your PAN card details:

- Incorrect Name: Spelling errors or name changes due to marriage.

- Wrong Date of Birth: Mistakes in your birthdate.

- Address Update: Change in residential address.

- Incorrect Father’s Name: Mistakes in the recorded father’s name.

- Photo Update: If your PAN card photo is outdated or unclear.

- Signature Mismatch: To update a new signature.

The PAN card change form allows you to make these necessary updates and ensures your financial records remain accurate.

How to Change PAN Card Details Online?

You can update your PAN card details online through the NSDL (now Protean eGov Technologies) or UTIITSL websites. Here’s how:

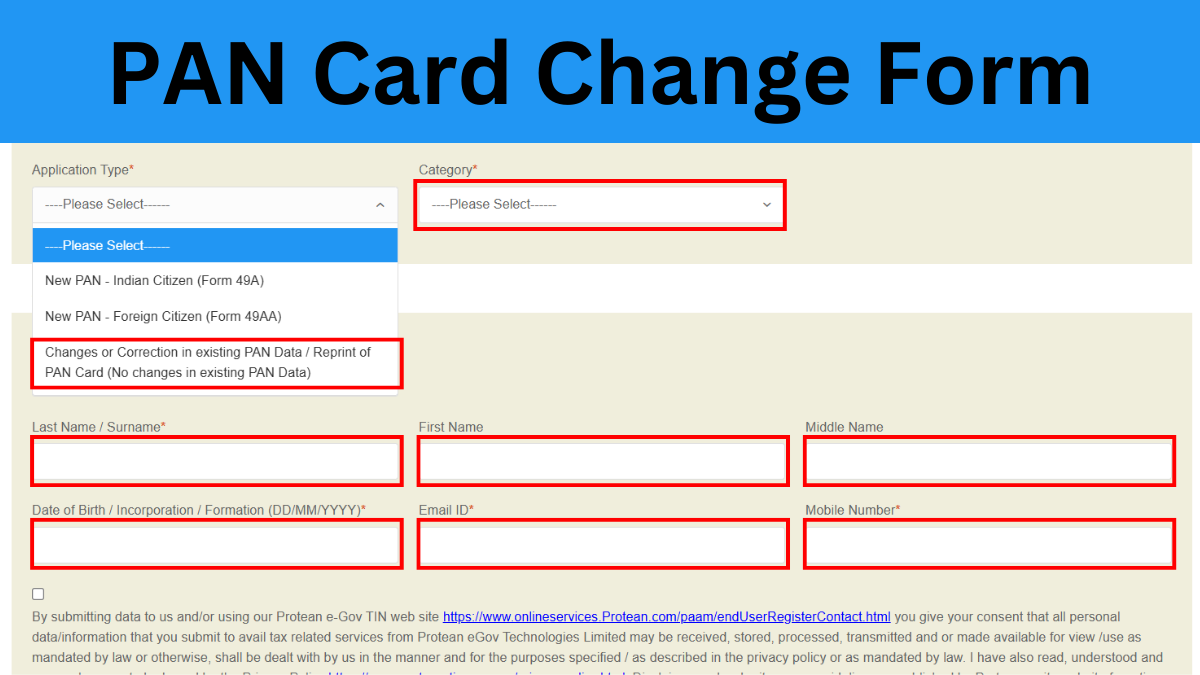

Step 1: Visit the Official Website

Go to the NSDL website or the UTIITSL website.

Step 2: Select the Correction Option

Choose “Changes or Correction in existing PAN Data/Reprint of PAN Card (No changes in existing PAN Data)” and proceed.

Step 3: Fill Out the PAN Card Change Form

Enter the required details carefully, including:

- PAN number

- Name (as per documents)

- Date of birth

- Contact information

- Fields that need correction

Step 4: Upload Supporting Documents

You will need to provide scanned copies of:

- Identity Proof: Aadhaar card, Passport, or Voter ID.

- Address Proof: Electricity bill, Bank statement, or Rental agreement.

- Date of Birth Proof: Birth certificate or Matriculation certificate.

- Name Change Proof (if applicable): Marriage certificate, Gazette notification, or Affidavit.

Step 5: Pay the PAN Card Correction Fee

- ₹107 (Including GST) for addresses within India.

- ₹1,017 for PAN cards to be dispatched outside India.

- Payment can be made using credit/debit cards, net banking, or demand draft.

Step 6: Submit the Application

After payment, you will receive an acknowledgment number. Keep this for future tracking.

Step 7: Send Physical Documents (If Required)

If Aadhaar-based authentication is not used, send a printed acknowledgment form, along with supporting documents, to the designated NSDL/UTIITSL address within 15 days.

How to Update PAN Card Details Offline?

If you prefer to update your PAN card details offline, follow these steps:

Step 1: Download the PAN Card Change Form PDF

- You can download the PAN card correction form PDF from the NSDL website or UTIITSL website.

Step 2: Fill Out the Form

- Enter the correct details and tick the boxes for the fields that need correction.

Step 3: Attach Supporting Documents

- Attach self-attested copies of required documents (identity, address, date of birth proof).

Step 4: Pay the Fee

- Pay ₹107 (India) or ₹1,017 (outside India) through demand draft.

Step 5: Submit the Form

- Send the completed form along with documents to the nearest PAN service center or NSDL/UTIITSL office.

Tracking Your PAN Card Correction Status

After applying, you can track your PAN card correction status by:

- Visiting the NSDL Track Status Page.

- Entering your acknowledgment number and submitting the request.

The corrected PAN card is usually delivered within 15 to 30 days after successful verification.

Read More: NSDL PAN Verification: How can I verify my PAN with NSDL?

FAQs about PAN Card Change Form

1. How can I change my PAN card online?

Visit the NSDL/UTIITSL website, fill out the PAN card correction form, upload the required documents, pay the fee, and submit the request.

2. Can I change my PAN ID?

No, you cannot change the PAN number itself, but you can correct personal details such as your name, date of birth, and address.

3. What is the fee for PAN card correction?

- ₹107 for India

- ₹1,017 for international addresses

4. What documents are required for PAN card correction?

- Identity Proof: Aadhaar, Passport, or Voter ID

- Address Proof: Electricity bill, Bank statement, or Rental agreement

- Date of Birth Proof: Birth certificate or School certificate

- Name Change Proof: Marriage certificate, Gazette notification, or Affidavit

5. Can I update my PAN card without Aadhaar?

Yes, you can use alternative identity proofs like Passport, Voter ID, or Driving License.

6. How long does PAN card correction take?

It usually takes 15 to 30 days for processing and dispatch.

7. Do I need to send physical documents for PAN correction?

Yes, if Aadhaar-based e-sign is not used, you must send a signed acknowledgment and documents to NSDL/UTIITSL.

8. How do I download the PAN card change form PDF?

Visit the NSDL website and download the PAN card correction form PDF.

Conclusion: PAN Card Change Form

Correcting your PAN card details is essential for maintaining accurate financial records and tax compliance. Whether you apply online through NSDL/UTIITSL or offline by submitting a physical form, ensure you provide the correct information and required documents to avoid rejection.

By following this guide, you can seamlessly update your name, address, date of birth, or other details using the PAN card change form. Stay updated with the latest guidelines by checking the official NSDL and UTIITSL websites. If you have further questions, refer to the FAQs above or contact the official PAN card helpline.