PAN Correction Form: Learn how to correct or update your PAN card details using the PAN Correction Form. This guide provides step-by-step instructions for both online and offline applications, including form downloads, required documents, and frequently asked questions.

PAN Correction Form

The Permanent Account Number (PAN) is a unique identifier issued by the Income Tax Department of India, essential for various financial transactions and tax-related activities. Ensuring the accuracy of your PAN details is crucial, as discrepancies can lead to complications in financial dealings. This comprehensive guide will walk you through the process of correcting or updating your PAN information using the PAN Correction Form, available through NSDL (now known as Protean eGov Technologies Limited) and UTI Infrastructure Technology Services Limited (UTIITSL).

Understanding the PAN Correction Form

The PAN Correction Form, officially titled “Request for New PAN Card or/and Changes or Correction in PAN Data,” is designed for individuals and entities who need to update or correct information associated with their existing PAN. Common corrections include:

- Name Changes: Due to marriage, legal name changes, or spelling errors.

- Date of Birth: Corrections to the recorded birth date.

- Father’s Name: Amendments for accuracy.

- Address Updates: Updating residential or office addresses.

- Signature Updates: Changing or updating the signature on record.

Read More: NSDL PAN Sign Resize: What is the rule of signature in PAN card?

How to Download the PAN Correction Form

1. Downloading from NSDL (Protean eGov Technologies Limited)

- Visit the Official Website: Navigate to the NSDL PAN services page.

- Access the Form: Click on “Change/Correction in PAN Data” to find the form.

- Download the PDF: Obtain the form titled “Request for New PAN Card or/and Changes or Correction in PAN Data.”

2. Downloading from UTIITSL

- Visit the UTIITSL Portal: Go to the UTIITSL PAN services page.

- Locate the Form: Find the section for PAN card services.

- Download the Form: Click on the link to download the PAN Correction Form in PDF format.

Steps to Apply for PAN Card Correction

1. Online Application Process

Applying online is a convenient and efficient method. Here’s how to proceed:

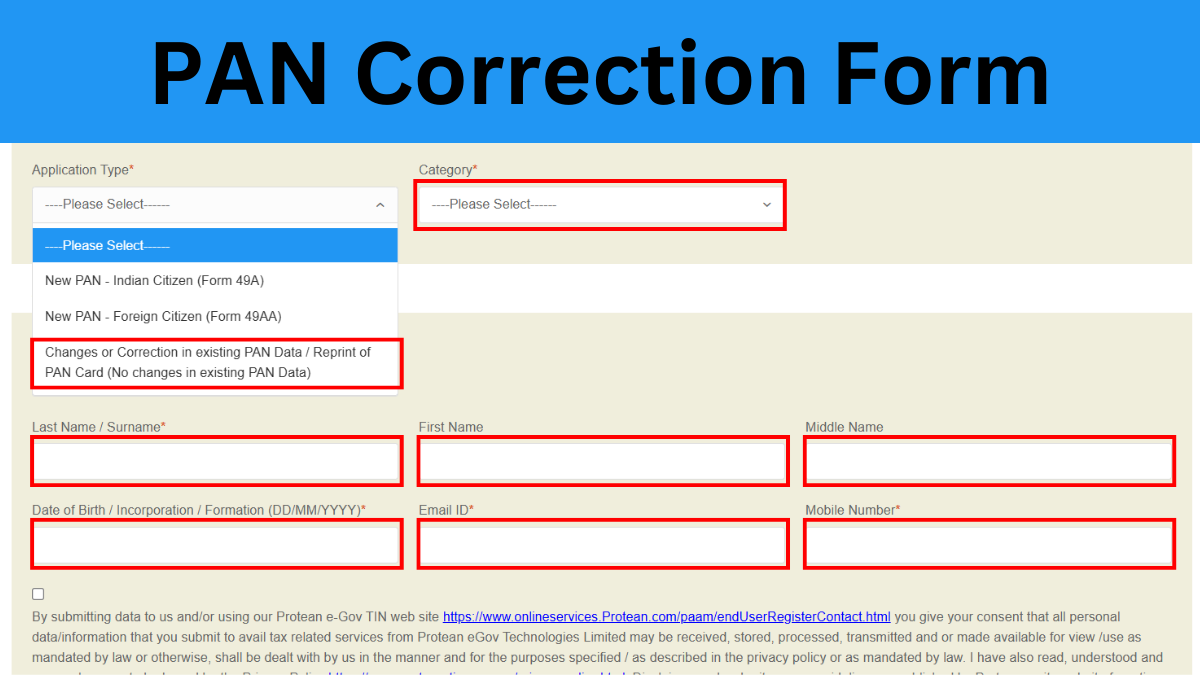

a. Through NSDL (Protean eGov Technologies Limited)

- Access the Online Portal: Visit the NSDL PAN correction page.

- Fill in the Application: Complete the online form with accurate details.

- Upload Documents: Provide scanned copies of necessary documents, including proof of identity, address, and the existing PAN card.

- Payment of Fees: Pay the processing fee online using net banking, credit/debit card, or other available methods.

- Submission: After reviewing the information, submit the application.

- Acknowledgment Receipt: Upon successful submission, an acknowledgment number will be generated. Save this for future reference.

b. Through UTIITSL

- Visit the UTIITSL Website: Navigate to the UTIITSL PAN correction page.

- Complete the Form: Fill out the online correction form with the necessary updates.

- Document Upload: Attach digital copies of required documents.

- Fee Payment: Pay the applicable fees through the available online payment options.

- Form Submission: Submit the completed form online.

- Receive Acknowledgment: Note the acknowledgment number provided for tracking purposes.

Also Read: NSDL PAN Address Update: How to Change PAN Card Address Online?

2. Offline Application Process

For those who prefer the traditional method, the offline process involves:

- Obtain the Form: Download and print the PAN Correction Form from the Income Tax Department’s website or collect it from authorized PAN centers.

- Fill in the Details: Carefully complete the form, ensuring all corrections are clearly indicated.

- Attach Supporting Documents: Include photocopies of relevant documents as proof of the changes requested.

- Affix Photographs: Attach two recent passport-sized photographs in the designated areas.

- Submit the Application: Visit the nearest PAN service center or TIN-Facilitation Center to submit the form and documents.

- Payment of Fees: Pay the processing fee at the center, which may vary based on the communication address (within India or abroad).

- Collect Acknowledgment: Receive the acknowledgment receipt for future reference.

Documents Required for PAN Correction

When submitting a PAN correction application, the following documents are typically required:

- Proof of Identity (POI): Aadhaar card, voter ID, passport, driving license, etc.

- Proof of Address (POA): Utility bills, bank statements, passport, Aadhaar card, etc.

- Proof of Date of Birth (DOB): Birth certificate, matriculation certificate, passport, etc.

- Existing PAN Card: Copy of the current PAN card issued.

Ensure that the documents provided are valid and match the information to be updated.

Processing Fee for PAN Correction

The processing fee for PAN correction varies based on the communication address:

- Within India: ₹110 (including Goods and Services Tax).

- Outside India: ₹1,020 (inclusive of dispatch charges).

Fees can be paid via:

- Online: Net banking, credit/debit card, UPI, etc.

- Offline: Demand draft payable to the service provider (NSDL or UTIITSL) at the designated address.

Tracking the Status of PAN Correction Application

After submitting the application, you can track its status:

- Visit the Tracking Page: Access the NSDL PAN status tracking or UTIITSL PAN status.

- Enter Details: Provide the acknowledgment number received during submission.

- View Status: Check the current status of your application.

| Step | Description |

|---|---|

| Download Form | Get the PAN Correction Form from NSDL or UTIITSL websites. |

| Fill the Form | Enter accurate details for correction (Name, DOB, Address, etc.). |

| Attach Documents | Provide POI, POA, DOB proof, and existing PAN copy. |

| Submit Online | Apply via NSDL/UTIITSL portals, upload documents, and pay fees. |

| Submit Offline | Visit the nearest PAN center with a completed form and required documents. |

| Fee Payment | ₹110 (India) / ₹1,020 (Outside India), payable online or via DD. |

| Track Status | Use acknowledgment number to track via NSDL/UTIITSL portals. |

| Receive Updated PAN | Processing takes 15-20 business days; new PAN is dispatched. |

Read More: NSDL PAN Agency Login: Complete Guide for Registration and Access

FAQs about PAN Correction Form

1. How long does it take to process a PAN correction application?

Typically, it takes about 15 to 20 business days from the receipt of the application for the updated PAN card to be dispatched. You can track the status online through NSDL or UTIITSL portals.

2. Can I make multiple corrections in a single application?

Yes, you can request multiple corrections (e.g., name, address, date of birth) in a single PAN correction application form. Ensure that you provide valid supporting documents for each correction.

3. Is it mandatory to submit proof for all corrections requested?

Yes, every correction requires corresponding supporting documents. For example:

- Name change: Aadhaar card, marriage certificate, or gazette notification.

- Address change: Utility bill, Aadhaar, or passport.

- Date of birth correction: Birth certificate or school certificate.

4. Will my PAN number change after correction?

No, your PAN number remains the same. Only the corrected details will be updated, and a new PAN card with the updated information will be issued.

5. Can I apply for PAN correction if I lost my original PAN card?

Yes, you can request a reprint of your PAN card along with corrections. Select the option “Reprint PAN Card” while filling out the form.

6. What should I do if my PAN correction request is rejected?

If your PAN correction request is rejected, check for the following issues:

- Incorrect or mismatched documents

- Incomplete form submission

- Discrepancy in details provided

To resolve this, correct the errors and reapply with accurate information.

7. Can I use my Aadhaar number to make PAN corrections?

Yes, you can use your Aadhaar number for authentication and to update your PAN details, provided both are linked.

8. Is there a deadline for PAN correction?

There is no specific deadline, but ensuring your PAN details are accurate is important for financial transactions, tax filing, and compliance.

Conclusion: PAN Correction Form

Keeping your PAN card details updated is crucial for smooth financial transactions, tax filings, and identity verification in India. Whether you need to correct your name, date of birth, address, or any other details, the NSDL and UTIITSL portals offer simple online and offline processes.

By following the step-by-step guide outlined above, you can easily apply for PAN correction, track your application status, and download your updated PAN card. Always ensure that you provide accurate information and valid supporting documents to avoid rejection.